If you are a U.S. person with investments in foreign companies, understanding how Passive Foreign Investment Companies (PFICs) affect your taxes is important. BS&P’s Senior Accountant Atira Boos answers your most commonly asked questions to keep you in the know.

What is a PFIC?

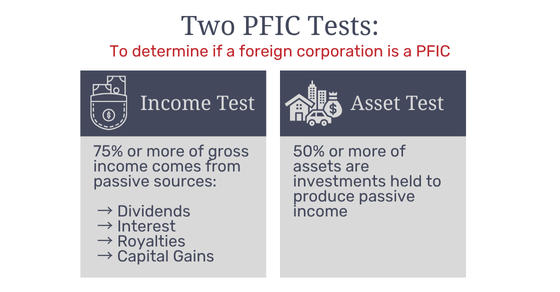

A PFIC, or Passive Foreign Investment Company, is a foreign corporation that generates mostly passive income or holds assets to generate passive income.

Some common types of investments that may qualify as a PFIC include:

- Foreign mutual funds

- Foreign exchange-traded funds (ETFs)

- Foreign real estate investment trusts (REITs)

- Foreign hedge funds

- Foreign stock companies

The IRS requires you to report PFIC investments on Form 8621 to prevent tax evasion by investing in foreign entities. Any U.S. person that has a direct or indirect ownership of a PFIC must file Form 8621 with their income tax return.

How does a PFIC affect your U.S. tax return?

Income from PFICs can be taxed in a few different ways on your U.S. return.

Are there exceptions to filing Form 8621?

There are few exceptions where you may not need to file Form 8621:

- De Minimis exception:

If the total value of your PFIC stock is $25,000 or less ($50,000 or less for married filing joint couples) at the end of the year, you don’t need to file Form 8621.

- Canadian Registered Retirement Savings Plans:

PFICs within a Canadian Registered Retirement Savings Plan, or RRSP, are exempt from PFIC reporting due to a special provision within the Canada-US Tax Treaty.

- The PFIC is a Controlled Foreign Corporation (CFC):

If the foreign corporation is a CFC (more than 50% owned by U.S. persons), you may need to still file Form 8621, but may not be subject to the PFIC tax treatment. CFC rules are complex, so please contact us if this may apply to you.

What are the penalties for not filing Form 8621?

Unlike other types of international informational reporting forms, the IRS does not clearly outline the exact monetary penalties for not filing Form 8621, or for filing it incorrectly. However, it is important to understand that if the form is not filed or filed late, you may face penalties.

PFIC rules are complex and can lead to significant tax implications. If you think you may have a PFIC investment and need to file IRS Form 8621, please reach out to us for personalized guidance. To learn more about our international tax services, visit us here.

Are you a U.S. citizen or resident with an ownership stake in a foreign company? Check out Atira’s reference guide here.