Are you an accounting student who is feeling overwhelmed by the recruiting process?

This column is a series intended to help you succeed as you begin your journey with the accounting profession.

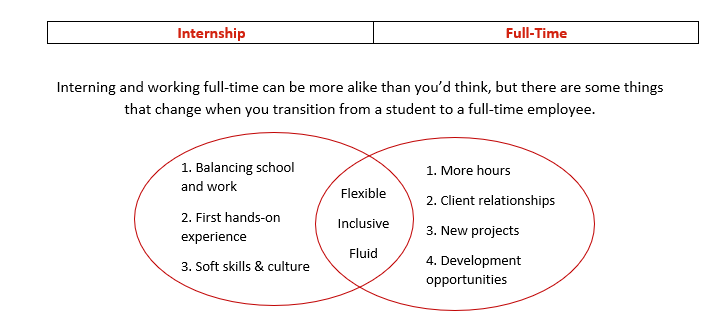

Internship

- As an intern through various Spring tax seasons, the hardest thing for me was learning how to juggle school, extracurriculars, and work. My recommendation is to say yes to what you can outside of your internship, but don’t spread yourself too thin. It’s great to be involved, but you don’t want to burn yourself out.

- An internship is the first time you get to see what working in the accounting field is like. Whether it be audit, tax, or something else, the firm expects that you don’t know much in terms of technical application. This is your opportunity to learn—try not to feel overwhelmed.

- Being an intern is a great way for you to learn about the culture of a firm. You can build relationships and work on developing your soft skills in a professional setting for the first time.

Full-Time

- The first major difference you’ll experience in your transition is the hours. It’s hard to adjust from a student schedule to a full-time 40-hour work week. It took me around a month or two to get adjusted. Busy seasons bring about their own challenges too. Some tips:

- Do your best to get enough sleep.

- Make time for fun outside of work and use your PTO.

- Try to eat well—diet has a huge impact on mood and overall well-being.

- Get to know your coworkers.

- I now have more responsibility in terms of client relationships. Every day I am communicating with clients from my list of assignments. This usually happens via email for me, but there are many times that I have answered questions over the phone.

- I now get to be a part of many more types of assignments than what I had experienced in my time interning. I went from working on only individual U.S. returns to now: cross-border returns with various foreign reporting requirements; C and S corps; partnerships; gift taxes; some auditing and assurance work.

- What I’ve found to be the most rewarding part of transitioning to full-time is the opportunity to develop professionally. Not only have I been improving my technical accounting skills, but I am also experiencing growth in other aspects. Here at BS&P, for example, I joined the brand-new Business Development Committee, which allows me to work on various levels of projects that interest me. This has given me a chance to explore some creativity but also be a part of something more impactful in terms of my personal development.

Both

Wherever you end up in the accounting field, there will be flexibility. The shift that has happened over the last few years has brought about things like working from home and flex-time. As an intern, your employer will work with you around your school schedule. As a full-timer, there are also ways to create a comfortable schedule.

Interning and full-time work also give you a chance to be involved beyond your job description. Deadline parties, firm retreats and picnics, the annual firm dinner, volunteering, and more are open to all at BS&P as well as at other firms. Interns are a valuable part of the team!

One thing that will never change when you choose a career in accounting is the aspect of constant learning. Rules and regulations change so much over time that this aspect alone provides opportunities to read up and prepare to help clients facilitate these changes.

Written by Katie Kriner, Staff Accountant